Unlocking Business Success with Advanced Payment Terminals: The Ultimate Guide

In the rapidly evolving landscape of modern commerce, the payment terminal has become an indispensable tool for businesses seeking to enhance operational efficiency, provide seamless customer experiences, and stay competitive. From retail outlets and restaurants to telecommunications providers and IT firms, the integration of cutting-edge payment terminals offers numerous advantages that translate directly into increased revenue, improved customer satisfaction, and long-term growth.

Understanding the Role of Payment Terminals in Modern Business

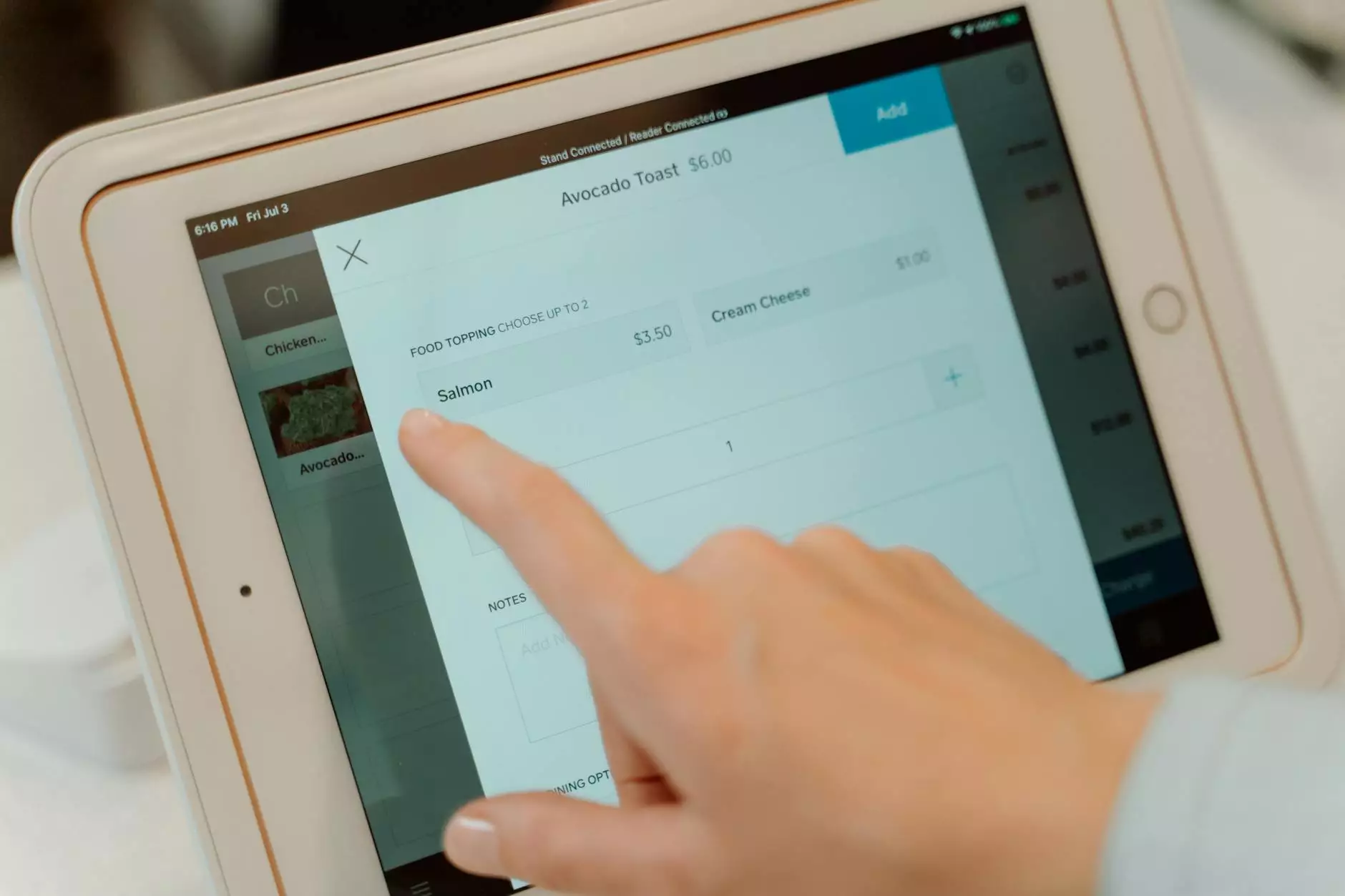

A payment terminal, often referred to as a point-of-sale (POS) device, is a hardware system designed to facilitate financial transactions between customers and businesses. These sophisticated devices go beyond simple card readers, offering multifunctional features such as contactless payments, mobile wallet compatibility, and secure transaction processing.

In today’s digital economy, the importance of effective payment terminal systems cannot be overstated. They serve as the primary interface for customers to execute their purchases, communicate payment information securely, and receive instant confirmation—all critical components that influence customer retention and loyalty.

Top Benefits of Implementing Modern Payment Terminals

- Enhanced Customer Experience: Fast, secure, and versatile payment options streamline checkout processes, reducing wait times and increasing customer satisfaction.

- Increased Sales Opportunities: Support for multiple payment methods—including contactless, mobile wallets, and international credit cards—broadens customer base and boosts sales.

- Improved Transaction Security: Advanced encryption and compliance with PCI DSS standards protect sensitive data, preventing fraud and minimizing liability.

- Operational Efficiency: Integration with inventory management, sales reporting, and CRM systems simplifies business operations and provides valuable insights.

- Regulatory Compliance: Modern payment terminals help businesses adhere to evolving legal standards related to data security and financial transactions.

How Payment Terminals Transform Telecommunications Businesses

The telecommunications sector is highly competitive and customer-centric. Offering flexible, secure, and quick payment options through advanced payment terminals not only enhances customer loyalty but also streamlines billing processes.

Facilitating Seamless Transactions in Telecom Stores

Telecom providers often deal with large volumes of transactions, including device sales, plan upgrades, and service payments. Modern payment terminals enable store staff to process multiple types of payments efficiently, whether through tap-and-go contactless cards, smartphone payments, or traditional chip-and-PIN transactions.

Enabling Remote Payment Solutions for Service Providers

With cloud-connected payment terminals, telecom companies can offer remote or online payment functionalities, simplifying the customer journey for bill payments or plan management—crucial in a digital-first environment.

The Impact of Payment Terminals in IT Services & Computer Repair Businesses

In the IT services and computer repair industry, trust and efficiency are key factors. Implementing state-of-the-art payment terminals ensures that transactions are swift and secure, reinforcing client confidence.

Facilitating On-the-Spot Payments and Invoicing

Whether on-site or via mobile units, IT service providers can leverage portable payment terminals to accept payments immediately after service completion, reducing payment delays and improving cash flow.

Enhancing Customer Data Security

Modern payment terminals integrate with customer databases securely, assisting in personalized billing and service offerings, thus boosting client retention.

Advancing Internet Service Providers with Cutting-Edge Payment Technologies

For internet service providers (ISPs), offering flexible and reliable payment options is vital for customer acquisition and satisfaction. Deploying robust payment terminal systems supports recurring billing models, one-time payments, and promotional offers with ease.

Streamlining Subscription Management

Subscription-based internet services benefit significantly from integrated payment terminals, allowing automatic renewals and seamless billing processes that reduce administrative overhead.

Supporting Multiple Payment Channels

Support for digital wallets, ACH transfers, and traditional credit/debit cards ensures that customers can choose their preferred payment method, facilitating quick sign-ups and renewals.

Key Features to Consider When Choosing a Payment Terminal

While selecting a payment terminal, businesses should evaluate various features that align with their operational needs:

- Compatibility: Ensure the device supports multiple payment types, including contactless, mobile wallets, and EMV chip cards.

- Security: Look for end-to-end encryption and compliance with PCI DSS to safeguard customer data.

- Connectivity: Options like Wi-Fi, Ethernet, or cellular connectivity provide flexibility for different business environments.

- Integration Capabilities: Compatibility with existing POS systems, inventory management, and reporting software enhances efficiency.

- User-Friendly Interface: An intuitive interface speeds up checkout processes and minimizes errors.

The Future of Payment Terminals in Business Growth

As technology continues to advance, payment terminals will become more intelligent, incorporating features such as biometric authentication, AI-driven analytics, and IoT connectivity. These innovations will empower businesses to personalize services, enhance security, and utilize data-driven insights to make strategic decisions.

Conclusion: Embracing Payment Terminals for Business Excellence

In an increasingly digital world, a well-implemented payment terminal system acts as a vital pillar supporting business growth and customer satisfaction. Whether operating within the realms of telecommunications, IT services, or internet provision, embracing modern payment solutions is not just advantageous—it's essential. By investing in reliable, secure, and flexible payment terminals, businesses position themselves at the forefront of technological innovation, ready to meet the demands of tomorrow’s consumers and markets.

For comprehensive, tailored payment terminal solutions that integrate seamlessly with your existing infrastructure, visit onlinefact.be. Enhance your operational capabilities, secure your transactions, and deliver outstanding customer experiences today.